Home

Trade ou pas Trade, le talkshow du trading

Categories: Videos, French

MACD-v: Volatility Normalised Momentum - A Twice Awarded Indicator

Categories: Education, Webinar

Una giornata di formazione a 360 gradi

Categories: Technical Analysis, Italian

The Roadmap from 2024: Harnessing Super Cycles

Categories: SAMT News, Education, Webinar

IFTA March 2024 update

Categories: SAMT News

Un’ottima performance (ma preoccupante)

Categories: Technical Analysis, Italian

An excellent (but worrying) performance

Categories: Technical Analysis

IFTA Journal 24 - now available

Categories: SAMT News

Martin Pring's 2024 Equity Market Outlook

Categories: Events, Videos, Webinar, Guest Author Article

S&P500 - Weekly Charts and potential outlooks for 2024 on Feb 3

Categories: Technical Analysis

S&P500 and Euro$ - Monthly Charts to Nurture the 2024 Debate

Categories: Technical Analysis

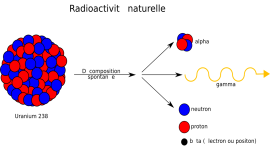

Attenzione a Yellowcake

Categories: Technical Analysis, Italian

Beware of the Yellowcake

Categories: Technical Analysis

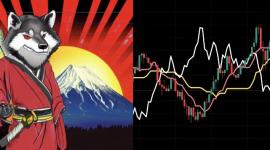

Chartist Triangles by The Wolf of Zurich

Categories: Technical Analysis, Education

IFTA Update December 2023

Categories: SAMT News

Risk-on: quanto può durare?

Categories: Technical Analysis, Italian

Risk-on: how long can it last?

Categories: Technical Analysis

"Santa Claus Is Coming To Town"?

Categories: Technical Analysis

DEVENIR RENTABLE EN BOURSE

Categories: Videos, Education, French

Tradingview - Black Friday Sale

Categories: Resources

In France we don't have Oil, but

Categories: Technical Analysis, harmonic patterns

The Pullback by James D.Touati

Categories: Education

"This is gold, Mr. Bond"

Categories: Technical Analysis

Long-term yields drive a potential risk-on phase

Categories: Technical Analysis

I tassi a lungo termine guidano una potenziale fase risk-on

Categories: Technical Analysis, Italian

GOLDFINGER: What's next? Italian version

Categories: Technical Analysis, Italian, Wolfe Waves, harmonic patterns

BITCOIN-Larry Fink, Cathy Wood, and Clubber Lang are on a boat-Arabic version

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

GOLDFINGER: What's next? Arabic version

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

BITCOIN-Larry Fink, Cathy Wood, and Clubber Lang are on a boat

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

GOLDFINGER: What's next?

Categories: Technical Analysis, harmonic patterns

SPECIAL CRYPTOS - Please, STOP your bla bla

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

NATURAL GAS - analysis over 20 years

Categories: Technical Analysis, harmonic patterns

PSYCHOLOGY and SELF-CONFIDENCE when you trade

Categories: Trading Psychology

bearish signals on the EUR/CHF - what to look out for now

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

IFTA Update September 2023

Categories: SAMT News

TOTAL (TTE) and WTI Crude Oil-New patterns detected

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

TOTAL (TTE) and WTI Crude Oil-New patterns detected (Arabic version)

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

NETFLIX-Important bearish patterns detected

Categories: Technical Analysis, harmonic patterns

GOOGLE-Bearish patterns have been detected

Categories: Technical Analysis, harmonic patterns

ICHIMOKU-6 points in 6 min (RU)

Categories: Education

Special CRYPTOS for MEMBERS ONLY - Potential Reversal Zone and purchasing levels

Categories: Technical Analysis

Stock sectors and relative strength: an analysis with monthly data

Categories: Technical Analysis

Settori azionari e forza relativa: un'analisi con i dati mensili

Categories: Technical Analysis, Italian

BITCOIN-Black Swan and Wolfe wave still valid

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

UBS The Bank-Special MORNING BULL (RU)

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

APPLE- Bearish Wolfe wave detected- Is a rebound possible?

Categories: Technical Analysis, Wolfe Waves

3M (Weekly) -Wolfe wave detected - divergence - PRZ to monitor

Categories: Technical Analysis, Wolfe Waves

UBS - bearish butterfly pattern detected

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

UBS "La banca" - speciale MORNING BULL (IT)

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

NASDAQ-Bearish Wolfe wave detected and targets estimations

Categories: Technical Analysis, Wolfe Waves

UBS "La Bank": special MORNING BULL - (FR)

Categories: Technical Analysis, Wolfe Waves, French, harmonic patterns

WTI Oil and Raw materials - can the drought in Panama create a bull run?

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

UBS The Bank - special MORNING BULL

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

Crude Oil: A reawakening for Inflation & Group Think?

Categories: Technical Analysis

DOW JONES (H1) - bearish SHARK pattern and Wolfe wave detected

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

SP500 "I believe I can Butterfly" (bearish)

Categories: Technical Analysis, harmonic patterns

UBS Group N - bearish Wolfe wave detected

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

DOW JONES - Wolfe wave detected (H4) and Head and Shoulders pattern?

Categories: Technical Analysis, Wolfe Waves

EUR/CHF - bullish Wolfe wave pattern detected

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

DAX 40 / NASDAQ / SP 500 (M15) - bearish "Black Swan" detected

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

KOTAK Mahindra Bank - a bearish Wolfe wave and a Bullish GARTLEY pattern detected

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

DAX40 - beautiful bearish GARTLEY detected - H1

Categories: Technical Analysis, harmonic patterns

NIFTY BANK - Wolfe wave detected

Categories: Technical Analysis, Wolfe Waves

What is the ICHIMOKU indicator and how does it work? The answer in 6 points and in 6 min

Categories: Technical Analysis, Education

UBS Group AG - bearish Wolfe wave and trendline to monitor

Categories: Technical Analysis, Wolfe Waves

DOW JONES - bearish Wolfe wave detected

Categories: Technical Analysis, Wolfe Waves

SP500 - bearish GARTLEY detected

Categories: Technical Analysis, harmonic patterns

BITCOIN - Possible rebound in a short term?

Categories: Technical Analysis, harmonic patterns

NVIDIA with high earnings expectations and a bearish Butterfly pattern pointing down

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

DAX 40 with an interesting GARTLEY pattern-is a rebound possible?

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

FTSE: important trend line and Butterfly pattern to monitor

Categories: Technical Analysis, Wolfe Waves, harmonic patterns

BITCOIN: two possible scenarios

Categories: Technical Analysis, Wolfe Waves

SP500 (H1): very interesting GARTLEY patterns

Categories: Technical Analysis, harmonic patterns

MICROSFT peut rejoindre sa MME.200 en journalier?

Categories: Technical Analysis, Wolfe Waves, French

Can MICROSOFT reach Its 200-day moving average?

Categories: Technical Analysis, Wolfe Waves

TESLA on a major support - rebound or breakout?

Categories: Technical Analysis, Wolfe Waves

TESLA sur un support majeur. Rebond ou cassure?

Categories: Technical Analysis, Wolfe Waves, French

WTI Crude OIL: is a rise to 88.87 USD possible?

Categories: Technical Analysis, Wolfe Waves

Pétrole brut WTI: une hausse à 88.87 USD est-elle possible?

Categories: Technical Analysis, Wolfe Waves, French

NASDAQ broke Its 50-day moving average? Watch out!

Categories: Technical Analysis, Wolfe Waves

NASDAQ: Cassure de la SMA.50 : Attention !

Categories: Technical Analysis, Wolfe Waves, French

Does the semiconductor index start a new downturn?

Categories: Technical Analysis, Wolfe Waves

L'indice des semiconducteurs commence t'il sa baisse?

Categories: Technical Analysis, Wolfe Waves, French

NVIDIA peut rejoindre ses GAPs? Cassure d'importantes lignes de trend

Categories: Technical Analysis, Wolfe Waves, French

will NVIDIA reach its GAPs? Trendline broken downwards

Categories: Technical Analysis, Wolfe Waves

AMAZON peut rejoindre son plus haut historique?

Categories: Technical Analysis, Wolfe Waves, French

Can AMAZON reach Its highest level?? Is the PACMAN pattern Bullish?

Categories: Technical Analysis, Wolfe Waves

Apple entame-t-il une correction ?

Categories: Technical Analysis, Wolfe Waves, French

Is Apple starting a correction?

Categories: Technical Analysis, Wolfe Waves

S&P500-Reversal risk in summer

Categories: Technical Analysis

Health Care: un settore da seguire

Categories: Technical Analysis, Italian

Health Care: a sector to watch

Categories: Technical Analysis

SAMT Zurich and Geneva event - presentation handouts

Categories: SAMT News, Events, Education

The Perils of "Painting the Tape"

Categories: Technical Analysis

IFTA June 2023 update

Categories: SAMT News

S&P500 entering weaker season May-October

Categories: Technical Analysis

How Investors Can Take Advantage of Seasonal Trends and Event Studies

Categories: Events, Webinar

Gold to consolidate before climbing to $2800

The US$ Index Turns Down Along the Cloud!

Categories: Technical Analysis

IFTA Update March 2023 update

Categories: SAMT News

Wolfe Wave pattern on CAC 40

Categories: Technical Analysis, Wolfe Waves

Trend and Volatility Strategies

Categories: Education, Webinar

DAX - a perfect Wolfe wave yet again

Categories: Technical Analysis, Education, Wolfe Waves

Kommt jetzt die große Korrektur beim DAX?

Categories: Technical Analysis

GOLD : too early to buy

Categories: Technical Analysis

market analysis - presentation handouts

Categories: SAMT News, Events, Education

S&P500 in uptrend

Categories: Technical Analysis

Mastering Trading Psychology

Categories: SAMT News, Events, Webinar

IFTA Journal January 2023 update

Categories: SAMT News

Will lightening strike twice?!

Categories: Technical Analysis

How to Use ADX and MACD Together

Categories: Events, Webinar

Expect a Triangle Pattern for Months in US 10-Year Treasury Yield

Categories: Technical Analysis

Webinar: Wyckoff Workshop with 6 presentations

Categories: Events, Webinar

IFTA Journal 23

Categories: SAMT News

Swiss Market Index SMI With A Possible Temporary Low

Categories: Technical Analysis, Guest Author Article

Bertschis CHART OUTLOOK SWISS EQUITIES

Categories: Technical Analysis

Trade With A Plan

Categories: Resources, Education, Trading Psychology

Trader Essentials - Business Shirts

Categories: Trader Essentials

IFTA September 2022 update

Categories: SAMT News

S&P500: to hedge or Not to hedge

Categories: Technical Analysis

Wyckoff Workshop with 4 presentations!

Categories: Events, Webinar

EUR/USD Parity: A Clear & Present Reality?

Categories: Technical Analysis

Seasonality patterns re-align

Categories: Technical Analysis

IFTA Update July 2022

Categories: SAMT News

S&P500: 3 bubbles - where is the bottom?

Categories: Technical Analysis

CFTe Digital Badges from IFTA

Categories: SAMT News, Education

Aumentano le evidenze di un'inversione della tendenza secolare dei prezzi dei titoli azionari

Categories: Technical Analysis, Italian

Growing Evidence that the Secular Trend in Equity Prices May be Reversing

Categories: Technical Analysis

IFTA global conference 2022 in Melbourne, AU

Categories: SAMT News, Events

S&P500: 2022 still Low of the Four-Year Cycle due Later

Categories: Technical Analysis

Buy Strength or Buy the Dip?

Categories: Technical Analysis

Comprare nella forza del mercato o nei ribassi?

Categories: Technical Analysis, Italian

Improving on ETFs: Get Higher Returns with Lower Risk

Categories: Technical Analysis

Come migliorare gli ETF: ottenere rendimenti più alti con un rischio inferiore

Categories: Technical Analysis, Italian

Il nuovo mondo delle obbligazioni

Categories: Technical Analysis, Italian

The new world of bonds

Categories: Technical Analysis

SAMT and NDR breakfast events

Categories: SAMT News, Events

IFTA Update March 2022

Categories: SAMT News

Bitcoin: BTCUSD 100k or 10k? UPDATE

Categories: Technical Analysis, Update, Guest Author Article

BTC: forecast for 2022, considering the fundamental situation

Categories: Technical Analysis, Guest Author Article

Telling the Truth After 12 Years of Trading

Categories: Events, Webinar

Crypto Markets and the Wyckoff Method: A Top-Down Approach

Categories: Events, Webinar

A Chartists View of the Markets in 2022

Categories: Technical Analysis, Webinar

Martin Prings 2022 Market Outlook

Categories: Events, Webinar

BTCUSD: 100k or 10k?

Categories: Technical Analysis, Guest Author Article

IFTA South East Asia Webinar Collaboration Market Outlook 2022: Breakout Recovery

Categories: Technical Analysis, Events, Webinar

IFTA Update January 2022

Categories: SAMT News

TEST TEST TEST diNapoli levels on the SMI

Categories: SAMT News

What Smoking Weed and Investing in The Stock Market Have in Common

Categories: Events, Webinar, Guest Author Article

2022 Global Outlook by NDR Research

Categories: SAMT News, Events, Webinar

Bitcoin: buy the dip!

Categories: Technical Analysis, Guest Author Article

GBPUSD Asymmetric Risk

Categories: Technical Analysis

job opportunity - Junior Technical Analyst

Categories: SAMT News

10 Key Asset Allocation Questions into Spring 2022

Categories: Technical Analysis, Events, Webinar

IFTA magazine by Connie Brown

Categories: SAMT News, Education

IFTA Journal 22 available

Categories: SAMT News

Introduction to Technical Analysis

Categories: Events, Webinar

IFTA Update September 2021 - now available

Categories: SAMT News

Dr. Copper's delicate condition

Categories: Technical Analysis

La delicata situazione del dottor Copper

Categories: Technical Analysis, Italian

Healthcare & Biotech

Categories: Technical Analysis

Farmaceutico & biotecnologie

Categories: Technical Analysis, Italian

US 10Treasury Yield: About to Give Signal for Sharp Rise ?

Categories: Technical Analysis

Oil running low on energy

Categories: Technical Analysis

IFTA webinar: Trend Following - A Complete Edge for the Private Investor - Part 2

Categories: SAMT News, Education, Webinar

IFTA webinar: Trend Following - A Complete Edge for the Private Investor - Part 1

Categories: SAMT News, Webinar

How to trade CFDs

Categories: Technical Analysis, Resources, Education

IFTA Update June 2021 - now available!

Categories: SAMT News

IFTA Webinar: The Case for 2021 Harnessing Super Long Term Cycles to Gain a Competitive Advantage

Categories: SAMT News, Webinar

Post-Pandemic Outlook From A Chartists Perspective

Categories: SAMT News, Videos, Education, Webinar

A new check on China & USA stock markets

Categories: Technical Analysis

Un nuovo confronto tra mercato azionario americano e cinese

Categories: Technical Analysis, Italian

9 examples of practical technical analysis

Categories: Technical Analysis, Resources, Education

Is Gold's trend still your friend?

Categories: Technical Analysis

The Unger Method

Categories: Resources, Book Reviews

Trading with Footprint Charts

Categories: SAMT News, Education, Webinar

Resumption of Downtrend for US$ Index!

Categories: Technical Analysis

SAMT Webinar: Elliott Wave Analysis – As applied to Foreign Exchange Markets

Categories: Education, Webinar

IFTA Update March 2021 - now available!

Categories: SAMT News

Rolf Bertschi's Chartoutlook for Swiss Equities

Categories: Technical Analysis, Resources, Guest Author Article

Cina e USA

Categories: Technical Analysis, Italian

China & USA

Categories: Technical Analysis

March 2021 Market Outlook

Categories: Technical Analysis

rotation from Growth to Value

Categories: Technical Analysis

EURUSD: A Computer-Generated Model Applying Harmonic Cycle Overtones (Data Sample: 1993 – 19/02/2021)

Categories: Technical Analysis

2021 Global Outlook & the Minsky Risk

Categories: SAMT News, Events, Webinar

S&P 500: è ora di una correzione?

Categories: Technical Analysis, Italian

S&P 500: is it time for a correction?

Categories: Technical Analysis

Equities extend higher into the Spring, perhaps next Summer

Categories: Technical Analysis

Gold -short term uptrend

Categories: Technical Analysis

SAMT Webinar: The Rising Star Ichimoku Strategy

Categories: SAMT News, Webinar

IFTA Update December 2020 - now available!

Categories: SAMT News, Journal

La rivoluzione del Biotech

Categories: Technical Analysis, Italian

Biotech revolution

Categories: Technical Analysis

Actively Using Passive Sectors to Generate Alpha Using The VIX

Categories: SAMT News, Webinar

Not a major top for Nasdaq100

Categories: Technical Analysis

IFTA 2020 online conference - SPEAKER RECORDINGS available

Categories: SAMT News, Webinar

2021 IFTA Journal - Now Available!

Categories: SAMT News

Interview with John Bollinger - Indexing for Technicians

Categories: Technical Analysis, Videos, Interviews

S&P in the run-up to the presidential election

Categories: Technical Analysis, Guest Author Article

IFTA Update: September 2020 Issue - Now Available!

Categories: SAMT News

Swiss Trading Day 2020

Categories: SAMT News, Events

IFTA, CFTe and MFTA Registration Information and Deadlines

Categories: SAMT News, Education

Increase Your Profits Systematically With Recurring Seasonalities and Cycles

Categories: SAMT News, Webinar

Three Steps to Better Decisions

Categories: Education, Trading Psychology, Guest Author Article

Gold: Ready to make a break to $2400?*

Categories: Technical Analysis, Videos

Using Relative Strength to Capture Mega Trends

Categories: SAMT News, Education, Webinar

S&P 500: tendenze future

Categories: Technical Analysis, Italian

S&P 500: what's next?

Categories: Technical Analysis

Bitcoin (BTC): grow potential by the end of 2020

Categories: Technical Analysis, Guest Author Article

Gold & Silver

Categories: Technical Analysis

Oro e argento

Categories: Technical Analysis, Italian

S&P500: breve analisi del trend

Categories: Technical Analysis, Italian

S&P500: a brief trend analysis

Categories: Technical Analysis

3 technical analysis methods applied on S&P500

Categories: Technical Analysis, Education

The Expander Strategy

Categories: Technical Analysis, Education, Webinar

Equity market crash: What next?

Categories: Technical Analysis, Videos, Interviews

S&P 500: some hypothesis about the trend

Categories: Technical Analysis

S&P 500: qualche ipotesi sulla tendenza

Categories: Technical Analysis, Italian

Analisi grafica del Coronavirus e dei mercati fin.

Categories: Technical Analysis, Italian

Graphical analysis of Coronavirus and financial markets

Categories: Technical Analysis

Coronavirus e S&P 500: prime considerazioni

Categories: Technical Analysis, Italian

Coronavirus and S&P 500: first thoughts

Categories: Technical Analysis

Crush it With Clouds

Categories: SAMT News

Virus and financial markets

Categories: Technical Analysis

The year of metals

Categories: Technical Analysis

IFTA Update: December 2019 Issue - Now Available!

Categories: SAMT News

A short analysis of the MSCI Russia Index

Categories: Technical Analysis

Italian Mid Cap Stocks

Categories: Technical Analysis

Yield curve and stock market

Categories: Technical Analysis

Charting the value of technical analysis

Categories: Videos

Gold and Silver

Categories: Technical Analysis

A new focus on Chinese and USA equities

Categories: Technical Analysis, Update

Defensive assets are topping out, for now

Categories: Technical Analysis

Equity markets short term trends: some considerations

Categories: Technical Analysis

IFTA Update: September 2019 Issue - Now Available!

Categories: SAMT News

Brexit trade idea | Long GBP/USD

Categories: Technical Analysis

GOLD: can the trend continue?

Categories: Technical Analysis

Benefit from Little Known Seasonal Patterns

Categories: SAMT News

Pay attention to Dr Copper

Categories: Technical Analysis

The fifth gold window

Categories: Technical Analysis

Bitcoin: some thougths

Categories: Technical Analysis

STOXX Europe 600 Utilities: a sector to watch

Categories: Technical Analysis, Update

The battle between US and China stocks

Categories: Technical Analysis

Spread BTP-BUND in a new normal

Categories: Technical Analysis

EUR-USD: some thoughts

Categories: Technical Analysis

S&P 500: a matter of levels

Categories: Technical Analysis

How important is trading psychology?

Categories: Videos, Trading Psychology

SAMT Journal Winter 2017

Categories: Journal

The Socionomic Theory Of Finance – by Robert R Prechter

Categories: Book Reviews

SAMT Journal Spring 2017

Categories: Journal

SAMT Journal Autumn 2016

Categories: Journal

SAMT Interview with Ian McAvity

Categories: Interviews

Guide To Creating A Successful Algo Trading Strategy

Categories: Book Reviews

SAMT Journal Spring 2016

Categories: Journal

SAMT Journal Autumn 2015

Categories: Journal

SAMT Interview with Bruno Estier

Categories: Interviews

SAMT Interview with Robin Griffiths

Categories: Interviews

SAMT Journal Spring 2015

Categories: Journal

Visual Guide To Elliott Wave Trading

Categories: Book Reviews

SAMT Journal Autumn 2014

Categories: Journal

Tools And Techniques For Profitable Trend Following

Categories: Book Reviews

SAMT Journal Spring 2014

Categories: Journal

SAMT Journal Winter 2013

Categories: Journal

Trading Beyond The Matrix – by Dr. Van K. Tharp

Categories: Book Reviews

SAMT Interview with Hank Pruden

Categories: Interviews

Trading Systems and Methods (Fifth Edition)

Categories: Book Reviews

The Janus Factor - by Gary Edwin Anderson

Categories: Book Reviews

SAMT Journal Summer 2013

Categories: Journal

SAMT Interview with Pring and Prechter

Categories: Interviews

SAMT Interview with Robert Prechter

Categories: Interviews

SAMT Journal Spring 2013

Categories: Journal

SAMT Interview with Martin Pring

Categories: Interviews

Categories

- SAMT News (47)

- Technical Analysis (175)

- Events (20)

- Webinar (31)

- Education (25)

- Update (3)

- Book Reviews (8)

- Videos (9)

- Interviews (9)

- Trading Psychology (4)

- Italian (24)

- Journal (12)

- Resources (6)

- Guest Author Article (11)

- Trader Essentials (1)

- Wolfe Waves (49)

- French (11)

- harmonic patterns (33)